Qatar Gratuity Calculator 2026: Updated with Labour Law

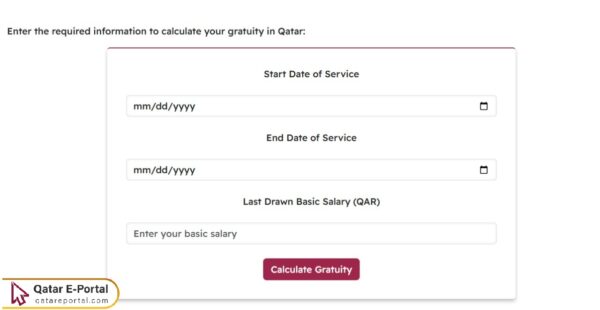

You can calculate your gratuity in Qatar using the following calculator:

Gratuity in Qatar

All employees in the private sector are entitled to an end-of-service gratuity in Qatar according to the current labor law. This is a gratuity for all workers who have served for at least one year, and it differs from the gratuity received by workers in the government sector, and also differs from the gratuity paid to domestic workers.

How to Use Gratuity Calculator in Qatar

To use gratuity calculator in Qatar, Just follow these easy steps:

- Enter the Start Date of Service using the calendar.

- Use the calendar to determine the End Date of Service.

- Type Last Drawn Basic Salary in the empty field.

- Click on the Calculate Gratuity icon to see the result.

Qatar Gratuity Calculation Formula

Gratuity in Qatar is calculated based on the following equation:

- Gratuity = 3 weeks pay x number of years of service.

Sample Calculation of Gratuity in Qatar

Here are some examples of calculating gratuity in Qatar:

- What is the end-of-service gratuity for an employee after 5 years if his last salary was 5,000 QAR?

- Gratuity = (5,000 QAR ÷ 26 Days × 21 Days) × 5 years

- Gratuity = 20,192 QAR

- What is the end-of-service gratuity for an employee after 3 years if his last salary was 7,000 QAR?

- Gratuity = (5,000 QAR ÷ 26 Days × 21 Days) × 5 years

- What is the end-of-service gratuity for an employee after 7 years if his last salary was 15,000 QAR?

- Gratuity = 3 weeks pay x number of years of service.

Gratuity in Qatar Upon Death

in the event that an employee dies during service, the employer must pay all of the employee’s entitlements, in addition to the end-of-service gratuity, regardless of the cause of death. The employer must submit a detailed report to the court detailing how the amounts were calculated in accordance with applicable laws and regulations.

Who is Not Eligible for Gratuity in Qatar

The worker is not entitled to an end-of-service gratuity in Qatar in any of the following cases:

- If the length of service with the employer is less than one year.

- If the worker impersonates another person, claims a nationality other than his own, or submits forged documents or certificates.

- If the worker commits an error that results in significant financial loss to the employer, provided that the employer informs the administration of the incident within a period not exceeding the end of the next working day after becoming aware of the incident.

- If the worker violates, more than once, instructions related to maintaining the safety of workers and the facility, despite being warned in writing, provided that these instructions are written and posted in a conspicuous place.

- If the worker breaches any of his essential obligations stipulated in the employment contract or by law more than once, despite being given a written warning.

- If he divulges secrets of the facility in which he works.

- If the worker is found during working hours in a state of apparent intoxication or under the influence of drugs.

- If the worker assaults the employer, manager, or a supervisor during or as a result of work.

- If the worker repeatedly assaults his colleagues during work despite being warned in writing.

- If the worker is absent from work without a legitimate reason for more than seven consecutive days or fifteen intermittent days during the year. If the worker is convicted by a final judgment of a crime affecting honor or trust.

What is Minimum Gratuity Benefit in Qatar

There is no limit to the minimum amount that a worker can receive as an end-of-service gratuity in the Qatari Labor Law, but the gratuity must not be less than three weeks’ wages for each year of service, and it may be more than that if the worker agrees with the employer upon signing the contract or upon termination of service.

Points to Consider for Qatar Gratuity Calculation

Here are several points to consider when calculating end-of-service gratuity in Qatar:

- Minimum One Year of Continuous Service: To qualify for gratuity under Qatar Labor Law, an employee must complete at least one full year of uninterrupted service with the same employer. Any break in service can affect eligibility or reset the gratuity calculation period.

- Standard Gratuity Formula: Applied The usual gratuity formula in Qatar is 21 days’ basic salary for every year of service. The calculation is: (Basic Salary ÷ 30) × 21 × Years of Service. Ensure your years are counted accurately for a correct amount.

- Calculation Is Based on Basic Salary: Gratuity is calculated using the employee’s last basic monthly salary, excluding allowances like housing, transport, or bonuses. Knowing your final basic salary is essential, as it directly determines the amount you’ll receive at the end of service.

- Reason for Leaving Affects Entitlement: Whether you resign or are terminated impacts your gratuity. Full gratuity is generally paid if the employer terminates you. If you resign before completing five years, your entitlement might be reduced depending on contract terms and reason for leaving.

- Final Dues Are Calculated Separately: Gratuity is separate from other dues like unused leave days, unpaid salary, or overtime. These should be calculated and paid in addition to gratuity. Review your final payslip and employment contract to ensure all entitlements are included.

Factors Affecting Gratuity Value in Qatar

Below are the main factors that affect the value of the end-of-service gratuity in Qatar:

- Length of continuous service.

- Final basic monthly salary.

- Reason for termination or resignation.

- Company’s internal HR policies.

- Inclusion or exclusion of unpaid leave.

- Absences without valid reason.

- Any legal deductions or penalties.

- Settlement of outstanding loans or advances.

- Applicable terms in employment contract.

Gratuity in Qatar for The Government Sector

The method of calculating end-of-service gratuity in Qatar differs significantly for the government sector and the private sector, and depends primarily on the number of years of service. Increasing the number of years of service changes the method of calculating the gratuity, as well as its value, as follows:

Government Sector Gratuity in Qatar Before 5 Years

The following equation explains how to calculate government sector gratuity in Qatar before 5 years:

- Gratuity = One month’s salary × Number of years of service

Government Sector Gratuity in Qatar After 5 Years

The following equation explains how to calculate government sector gratuity in Qatar after 5 years:

- Gratuity = (One month’s salary × 5) + (One month’s salary × 1.5 × The remaining years after the first 5 years of service)

Government Sector Gratuity Calculation in Qatar After 10 Years

The following equation explains how to calculate government sector gratuity in Qatar after 10 years:

- Gratuity = (One month’s salary × 5) + (One month’s salary × 1.5 × 5) + (One month’s salary × 2 × The remaining years after the first 10 years of service)

Gratuity in Qatar for Housemaid

A domestic worker in Qatar receives an end-of-service gratuity if they leave their job after one full year of service with the same employer. This gratuity must be no less than three weeks’ wages for each year, including fractions of a year. This means that the value of the gratuity paid to a domestic worker is equal to that paid to a private sector worker.

Questions & Answers

How gratuity is calculated in Qatar?

End-of-service gratuity in Qatar is calculated based on 21 days' salary for each year of service.

How much gratuity do I pay in Qatar?

The employer must pay the employee end-of-service gratuity as agreed in the contract, provided that it is not less than 21 days' salary for each year.

Can I get gratuity if I resign Qatar?

Yes, the employee is entitled to end-of-service gratuity in Qatar upon resignation.

What is the gratuity for domestic workers in Qatar?

The end-of-service gratuity for domestic workers in Qatar is equivalent to the gratuity received by an employee in the private sector.

What if the employer does not pay the gratuity in Qatar?

If the employer does not pay end-of-service gratuity in Qatar, a labor complaint can be filed through the unified platform for complaints and reports on the Ministry of Labor's website.